NEW LEGISLATION WOULD PROVIDE MORE INFORMATION ABOUT COLLEGES AND STUDENT DEBT

By Lauryn Cantrell, Staff Writer

Virginia Senator Mark Warner reintroduced two bipartisan education bills this week designed to ensure current and prospective college students have access to better college data and financial counseling.

“We want to make sure you’re an informed consumer before you choose a college, and that once you’re in college and acquiring student debt, there is a process so you are aware of what you’re getting yourself into,” explained Warner. “While these bills may not solve the whole problem regarding student debt, we will be taking good steps in the right direction.”

In a phone conference with student journalists from Virginia universities, Warner highlighted the need to provide students, especially undergraduates, the proper resources to determine where to attend college as well as the financial implications of taking out student loans.

“[The two bills] are an outgrowth of my interest in how we grapple with the increasing costs of higher education and the challenges of student debt,” said Warner. “I know as somebody who was the first person in my family that graduated from college, I’m not sure that I could have afforded to go to college in today’s environment.”

The Student Right to Know Before You Go Act will increase availability of more accurate information about colleges and universities. The Department of Education makes institutional data available through its College Scorecard, but the information is limited.

The new bill would create a comprehensive, user-friendly online database for information submitted by states and universities, as well as the Department of Veterans Affairs, the Treasury Department and the Social Security Administration. The database would include debt loans, transfer rate, graduation, as well as job outlook for student’s majors and areas of study.

The bill was brought forward in previous Congressional sessions, but the revised 2017 version adds privacy protections through encryption of students’ individual information.

The Empowering Students Through Enhanced Financial Counseling Act would give students the tools and information needed to borrow and pay their student loans responsibly.

“When Senator Kaine and I met with students of the commonwealth a few years back, one of their biggest concerns was how easy it is to obtain loans and accrue debt,” said Warner, “but [they] wouldn’t know how this will translate into the amount of monthly payments and the burden it may put you under.”

The bill includes interactive counseling as well as an annual sign-off for students’ previous loans so they do not unknowingly accrue more debt. Low-income students who are Pell Grant recipients will receive additional annual counseling to be better informed about the terms and conditions of the program.

“After undergraduate and law school I had a combined $15,000 in debt,” said Warner. “While that seemed like a lot 40 years ago, it really is nothing compared to some of the levels of debt students take on today.”

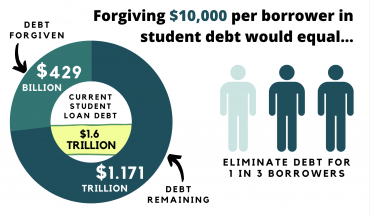

Currently, the average Virginia public university student will graduate with $29,000 in student debt, and total student loan debt stands at $1.45 trillion nationwide according to statistics released by Senator Warner’s office in March 2017.

Warner partnered with senators from both major parties to reintroduce the legislation. The bipartisan spirit, Warner said, strengthens potential support for passing the bills, which are designed to support students and their families to make well-informed decisions about their academic careers.